ANFI is a majar

International producer of packaged food, Indian specialty Basmati rice with

sales in over 60 countries. It generates the majority of its revenue through

the sale of Basmati rice, a long-grain rice grown only in certain regions of

the Indian subcontinent, selling its products, primarily in emerging markets,

through a distribution network.

Looking at what the CEO

Mr. Karan A Chanana has to say about Amira's successes and failures, it is

clear that he has delivered on most of his statements in the past. In January

2013, when Amira's brand was selling in 40 countries, he estimated that it will

sell in 70 countries by 2017. Today, the brand has already reached sales in 60

countries. There have been some delays in certain projects like the debt issue

where the attempted offering of $225 million Senior Secured Second Lien Notes

due in 2020 failed because of a short-selling attack by prescience Consequently,

the building of the new processing factory that would have enabled even faster

future growth was delayed. But the business model of Amira as it is now is

working pretty well and the earnings are growing. The company is expanding

globally and last year increased its revenue by 35%. Also a development that

has worked was the increase of up to 15 distribution centers in India to

exploit the promising demographics and economic development in India. If we

estimate future projections like the goal of reaching 1 billion in revenues

through the analysis of past projections, we can be very confident in the

current management team.

Possible catches - the

cheapness of the Amira stock

As it is not an US

company, investors find it difficult to trust a business from another part of

the world. It is very difficult to call your mate from college and ask about

the building of some distribution centre in north India. On the other hand, we

can simply walk into department stores and see the rice they sell. For me,

those are stores like tesco, Asda, Waitrose and Morrison in the UK and for

US readers it should be Costco with new additions coming month by month. This

research aims to show that unfamiliarity can be a great play for investors.

The second issue is the financing problem that arose after

missing the bond issue because of a short-seller attack a few months ago. This

was quite unfortunate for Amira because of the relatively high interest rates

in India, but nothing that deteriorated the current situation that is very

positive by itself. The way Amira does business now by financing operations

through a consortium of Indian banks works pretty well, so a future possible

lowering of the interest rate would only be beneficial.

The third issue that is also related to the second one is the

continuous delays in finishing the new factory because of lack of financing.

The CEO promises updates on finishing factory in the next quarterly

presentation. The new factory would only improve the growth possibilities and

future outlook for Amira.

The forth possible issue is the expected growth of the rice crop

2015 that will impact volume, thus lower prices. Also not such a bad thing

because the consumer will get a better price and Amira will have the

opportunity to increase the margins and pass some of the price decreases to its

customers.

The fifth issue is that the organic product is still not on US

shelves. Here it has to be said that the business model of Amira involves an

aging process of more than 12 months, so it takes time for the new product

lines to reach its customers. It is understandable that Wall Street would like

everything immediately, but this gives the opportunity to more patient

investors to buy a gem in the making, and let it age to grasp all the flavors

by letting it become older and better (the rice and also the stock). The CEO announced

the organic product line on US shelves by the end of this year.

The sixth issue could be the possible diminishing demand from

Middle East countries because of lower oil prices and thus lower purchasing

power. Amira wants to be a global player, and partly already is one, so

geographical diversification lowers specific geographical risks.

The seventh reason can be the very extensive global growth plans

that might be overstretching the possibilities of Amira and putting more risk,

but 27 million of cash with 20 million more of available financing plus

negotiations for more finances should help, and a low debt-to-equity ratio

makes this an unlikely risk (Total debt/LTM adj. EBITDA = 2.0x). A financial

crisis that would hit the eastern markets might shake a little bit its

financial position, but again, with the growth going on in Asia, it is

something unlikely to happen. The competitor KRBL expects rice market volume to

grow at a CAGR of 7% in India for the coming years.

The eighth reason can be

that Amira is developing a brand strategy. You probably know of places where

the atmosphere is nicer, the coffee is better and much cheaper than at

Starbucks but the brand is what attracts people to it. Amira is trying to

create that feeling in the premium Basmati rice growing segment. If it

succeeds, we have in our hands a stock that might be the one that we will be

telling stories to our grandchildren. If it does not succeed in creating a

worldwide famous rice brand, it will probably be bought out by a large corporation

at a nice premium. So for the long-term investors, there is a win-win situation

with low possible downside risks at the current pricing.

Comparison with KRBL

KRBL is the world's

largest rice miller and Basmati rice exporter. The company is quoted on the NSE

(Indian National stock exchange) and BSE (Bombay stock exchange). It operates

in the same market as Amira but without the global focus. The growth of the two

companies has been almost the same that can be seen in the following table.

Here we have also to take into account that the accounting currency for KRBL is

the Indian Rupee and for ANFI the US dollar. The deprecation of 18.9% in the period from January 2011 till December

2014 of the Indian Rupee in relation to the US dollar makes ANFI's numbers look

even more impressive.

Source: ANFI and

KRBL investor presentations. Data for KRBL is in thousands of Lacs and

data for ANFI in million USD.

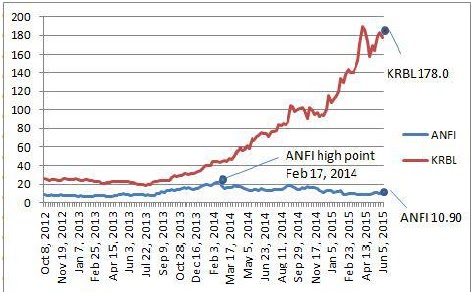

But looking at the graph that compares the stock prices of ANFI and

KRBL since the quotation of ANFI on the NYSE, we can see the same pattern up to

February 17, 2014 which was the high point of ANFI. After that, with only good

news from the company, beating estimates with growing revenues and earnings,

the stock has not been the investors' favorite on the NYSE. For KRBL, which is

an Indian company quoted in India, the story is completely different where the

stock price has followed the developments in the business. It can be assumed

that the same will happen for ANFI, so now is a great opportunity to buy at

this bargain prices.

Graph 1. Comparison of stock price movement ANFI and KRBL

Source: yahoo.com/finance

Conclusion

It is our opinion that all the possible risks are already

calculated in the price and also overestimated. Thus for now, we expect at

least a PE of 15 for ANFI that brings us to a current valuation of $20.25 per

stock. Viewing the current developments and future possibilities when we

account for a sustainable 20% growth rate in the next 5 years with a PE of 15,

we estimate a price of $51.05 per stock.

Looking at the downside, the risks are minimized as all the

possible negative developments that in reality are just plan delays have

already been accounted in the price thus giving a great buying opportunity.

Amira could be a gem to own in order to exploit the developments

and growth in the healthy food and organic segment plus the big possibilities

arising from the economic growth of the Indian subcontinent.

No comments:

Post a Comment